Roofing financing in Orlando refers to various financial options that allow homeowners to pay for their roof replacement or repair project over time, rather than paying the entire cost upfront. In the Orlando area, where severe weather conditions like hurricanes and storms can cause significant damage to roofs, having access to financing solutions is crucial for many homeowners.

The purpose of roofing financing is to make the cost of a new roof or major repairs more manageable by spreading out the payments over an extended period. This can be particularly helpful for homeowners who may not have the necessary funds readily available or who want to preserve their savings for other expenses.

Roofing financing in Orlando is important for several reasons:

-

Affordability: A new roof can be a significant investment, with costs ranging from several thousand dollars to tens of thousands, depending on the size, materials, and complexity of the project. Financing options make this expense more affordable by breaking it down into smaller, manageable payments.

-

Timely Repairs: Delaying necessary roof repairs or replacements due to financial constraints can lead to further damage and potentially more expensive repairs down the line. Financing allows homeowners to address roofing issues promptly, preventing escalating costs and protecting their homes.

-

Preserving Savings: Instead of depleting their savings or emergency funds, homeowners can utilize roofing financing to pay for their project while maintaining their financial reserves for other expenses or unexpected events.

Overall, roofing financing in Orlando provides homeowners with the flexibility and financial assistance needed to ensure their homes are protected from the elements and maintain their value, without putting undue strain on their budgets.

Why Consider Financing for Your Orlando Roof?

Financing your roof replacement or repair in Orlando can offer several advantages. One of the primary benefits is improved affordability. A new roof can be a significant expense, often costing tens of thousands of dollars. By financing the project, you can break down the cost into manageable monthly payments, making it more accessible for homeowners on a budget.

Additionally, financing provides flexible payment options. Depending on the lender and the terms you qualify for, you may have the opportunity to choose a repayment period that aligns with your financial situation. This flexibility can help you better manage your cash flow and avoid the strain of a single, large payment.

Another advantage of financing is the protection it offers against unexpected expenses. Roofing projects can sometimes encounter unforeseen issues or require additional work, which can drive up the overall cost. With financing in place, you have a buffer to cover these potential extra expenses without having to scramble for additional funds.

Furthermore, some financing options may offer promotional rates or special incentives, potentially saving you money on interest or providing other benefits. This can make financing an even more attractive option, especially for those who prioritize cost-effectiveness.

Types of Roofing Financing Options in Orlando

Orlando homeowners have several financing options to consider when it comes to paying for a new roof or major roof repairs. Here are some of the most common types of roofing financing available in the area:

Unsecured Personal Loans: These loans are not secured by any collateral and are based solely on your creditworthiness. They can be obtained from banks, credit unions, or online lenders, and typically have fixed interest rates and repayment terms ranging from 1 to 7 years.

Credit Cards: While not a dedicated financing option, credit cards can be used to pay for roofing projects, especially if you have a card with a 0% introductory APR period. However, it’s crucial to pay off the balance before the promotional period ends to avoid high interest charges.

Home Equity Loans or Lines of Credit: If you have built up equity in your home, you can borrow against it through a home equity loan or line of credit. These options typically offer lower interest rates than unsecured loans, but your home serves as collateral.

Contractor Financing Programs: Many roofing contractors in Orlando partner with third-party lenders to offer financing options directly to their customers. These programs may have varying interest rates and repayment terms, but they can be a convenient way to finance your roofing project through the contractor.

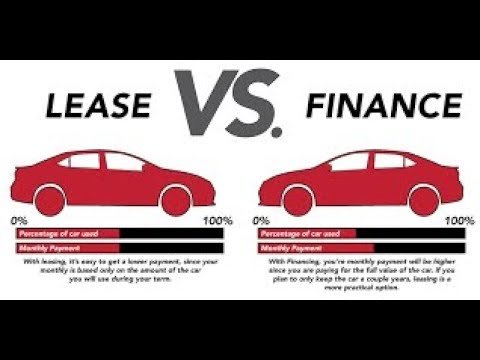

Rent-to-Own or Lease-to-Own Options: Some roofing companies in Orlando may offer rent-to-own or lease-to-own programs, where you can essentially “rent” a new roof and make monthly payments until you own it outright. These options can be more expensive in the long run but may be suitable for those with limited upfront funds.

When considering your financing options, it’s essential to compare interest rates, fees, and repayment terms to find the most affordable and suitable option for your financial situation.

Understanding Loan Terms and Eligibility

When exploring roofing financing options in Orlando, it’s crucial to understand the various loan terms and eligibility criteria involved. Key factors to consider include interest rates, repayment periods, fees, credit requirements, and the factors lenders evaluate for approval.

Interest rates play a significant role in determining the overall cost of your roofing loan. Higher interest rates translate to higher monthly payments and a more substantial amount paid over the life of the loan. Lenders typically offer varying interest rates based on your credit score, income, and the loan amount.

Repayment periods, also known as loan terms, refer to the length of time you have to repay the borrowed amount. Shorter repayment periods, such as 3 to 5 years, typically come with lower interest rates but higher monthly payments. Longer repayment periods, ranging from 10 to 20 years, offer lower monthly payments but result in paying more interest over the life of the loan.

It’s essential to consider any additional fees associated with the loan, such as origination fees, processing fees, or prepayment penalties. These fees can add to the overall cost of the financing and should be factored into your decision-making process.By understanding these key loan terms and eligibility criteria, you can make an informed decision and choose the roofing financing option that best suits your financial situation and roofing needs in Orlando.

Choosing the Right Financing Option

Selecting the appropriate financing option for your Orlando roofing project is crucial to ensure a seamless and stress-free experience. With various options available, it’s essential to consider your individual circumstances, creditworthiness, and budget to make an informed decision.

First and foremost, assess your credit score and history. A higher credit score typically qualifies you for more favorable interest rates and loan terms. If your credit score is less than ideal, you may need to explore options with more lenient requirements or consider improving your credit before applying.

Next, evaluate your budget and determine how much you can comfortably afford in monthly payments. Roofing financing options range from unsecured personal loans to home equity loans or lines of credit. Each option comes with its own set of advantages and drawbacks, so it’s essential to understand the long-term implications of each choice.

Unsecured personal loans are often easier to qualify for and can provide funds quickly, but they may come with higher interest rates and shorter repayment terms. On the other hand, home equity loans or lines of credit typically offer lower interest rates and longer repayment periods, but they require equity in your home and put your property at risk if you default on payments.

Additionally, consider the potential tax benefits associated with certain financing options. Home equity loans or lines of credit may allow you to deduct the interest paid on your taxes, providing an added financial advantage.

Ultimately, the right financing option for you will depend on your unique financial situation, the urgency of the roofing project, and your long-term goals. It’s advisable to consult with a financial advisor or speak with multiple lenders to explore your options and find the best fit for your needs.

Working with Orlando Roofing Contractors

When it comes to financing your roofing project in Orlando, working with reputable and experienced roofing contractors is crucial. These professionals can guide you through the entire process, from assessing your roofing needs and providing cost estimates to recommending the best financing options and assisting with the application process.

Reputable Orlando roofing contractors typically have established relationships with various lenders and financing companies, allowing them to offer a range of financing solutions tailored to their clients’ needs. They can explain the different options, such as unsecured personal loans, home equity loans, or specialized roofing financing programs, and help you determine which one best fits your budget and circumstances.

Moreover, roofing contractors can provide valuable insights into the financing process, ensuring you understand the terms, interest rates, and repayment schedules. They can also help you navigate any documentation or paperwork required, making the process smoother and more efficient.

When choosing a roofing contractor in Orlando, it’s essential to work with a company that has a proven track record of integrity, quality workmanship, and excellent customer service. Look for contractors who are licensed, insured, and have positive reviews from previous clients. They should also be transparent about their pricing, financing options, and the materials they use.

By working closely with a reputable Orlando roofing contractor, you can have peace of mind knowing that your roofing project is in capable hands, and you have access to financing solutions that fit your needs and budget.

Estimating Roofing Costs in Orlando

Accurately estimating roofing costs in Orlando is crucial for homeowners planning a roof replacement or repair. The cost of a new roof can vary significantly depending on several factors, including the size of the roof, the materials used, the complexity of the job, and the contractor’s expertise.

In Orlando, the average cost for a new asphalt shingle roof on a typical single-family home can range from $8,000 to $15,000. However, this is just a rough estimate, and the actual cost may be higher or lower based on your specific project requirements.

Factors that can influence roofing costs in Orlando include:

-

Roof Size: The larger the roof, the more materials and labor will be required, resulting in higher costs.

-

Roofing Material: Asphalt shingles are the most common and affordable option, but other materials like tile, metal, or slate can significantly increase the overall cost.

-

Roof Complexity: Roofs with multiple levels, steep pitches, or intricate designs will require more labor and expertise, leading to higher costs.

-

Roof Removal and Disposal: If your existing roof needs to be removed and disposed of properly, this will add to the overall cost.

-

Additional Work: If your roof requires repairs to the underlying structure, such as replacing damaged decking or reinforcing trusses, this will increase the overall cost.

-

Contractor Reputation and Experience: Highly reputable and experienced roofing contractors in Orlando may charge more for their services, but they often provide better workmanship and warranties.

To ensure accurate cost estimates, it is essential to have a professional roofing contractor inspect your roof and provide a detailed quote. Reputable contractors will take into account all the factors mentioned above and provide a comprehensive breakdown of the costs involved. This will help you budget appropriately and avoid unexpected expenses during the roofing project.

Preparing for the Financing Process

Proper preparation is key to securing the best financing terms for your Orlando roofing project. Here are some essential steps to take before applying for financing:

-

Gather Documentation: Lenders typically require various documents to assess your creditworthiness and ability to repay the loan. These may include proof of income (pay stubs, tax returns), bank statements, identification documents, and information about existing debts or assets.

-

Review Your Credit Report: Your credit score plays a significant role in determining the interest rates and terms you’ll be offered. Request a copy of your credit report from the major credit bureaus and review it for accuracy. Dispute any errors or inaccuracies that could be negatively impacting your score.

-

Improve Your Credit Score: If your credit score is less than ideal, take steps to improve it before applying for financing. Pay down outstanding debts, ensure timely payments on existing loans or credit cards, and avoid opening new lines of credit unnecessarily.

-

Understand the Application Process: Familiarize yourself with the lender’s application process, required documentation, and any fees or charges associated with the loan. This will help you prepare accordingly and avoid delays or surprises during the application process.

-

Get Pre-Approved: Many lenders offer pre-approval processes, which can give you a better idea of the loan amount and terms you may qualify for. This can help you plan your roofing project more effectively and negotiate better prices with contractors.

-

Compare Offers: Once you’ve applied for financing, compare the offers from different lenders carefully. Look at the interest rates, repayment terms, fees, and any additional benefits or restrictions. Don’t be afraid to negotiate for better terms or shop around for the best deal.

By taking these preparatory steps, you’ll increase your chances of securing favorable financing terms and ensure a smoother process for your Orlando roofing project.

Managing Roofing Financing Responsibly

Taking on financing for your Orlando roofing project is a significant financial commitment. It’s crucial to approach it responsibly to avoid potential pitfalls and ensure a smooth repayment process. Here are some tips to help you manage your roofing financing effectively:

Create a Detailed Budget: Before securing financing, create a comprehensive budget that accounts for the roofing costs, interest rates, and any additional fees. This will help you understand the total cost of the project and plan your monthly payments accordingly.

Prioritize Timely Payments: Missing payments or making late payments can result in additional fees, interest charges, and negative impacts on your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Avoid Overspending: While it’s tempting to finance more than you need for the roofing project, resist the urge. Stick to the necessary expenses to avoid accumulating unnecessary debt and interest charges.

Monitor Your Credit Report: Regularly check your credit report to ensure accurate reporting of your roofing financing payments. Promptly address any errors or discrepancies to maintain a healthy credit score.

Communicate with Your Lender: If you experience financial difficulties that may impact your ability to make payments, reach out to your lender immediately. They may be able to offer assistance or modify your repayment plan to avoid delinquency or default.

Explore Debt Consolidation Options: If you have multiple debts, including your roofing financing, consider consolidating them into a single payment. This can simplify your finances and potentially lower your overall interest rates.

By managing your roofing financing responsibly, you can protect your credit score, avoid unnecessary fees and penalties, and maintain a solid financial standing for future borrowing needs.

Local Resources and Assistance Programs

Orlando homeowners looking for financial assistance with roofing projects may find relief through various local resources and government-backed programs. One notable option is the City of Orlando’s Housing Rehabilitation Program, which provides low-interest loans and deferred payment loans to eligible homeowners for essential repairs, including roof replacements.

Additionally, the State of Florida offers the Weatherization Assistance Program (WAP), which helps low-income households improve their homes’ energy efficiency, often by addressing issues with roofing and insulation. Homeowners may qualify for grants or low-interest loans through this program.

Nonprofit organizations like Habitat for Humanity and Rebuilding Together also operate in the Orlando area, offering assistance with home repairs and renovations for those who meet specific income criteria. These organizations may provide volunteer labor, discounted materials, or financial aid for roofing projects.

Furthermore, the Federal Housing Administration (FHA) and the U.S. Eligible homeowners may be able to finance their roofing projects through these government-backed loan options.

It’s essential to research and explore these local resources and assistance programs thoroughly, as eligibility requirements and application processes may vary. Working with a knowledgeable roofing contractor or a housing counselor can help navigate the available options and ensure a smooth financing process.

FAQs about Orlando Roofing Financing

What types of roofing projects can be financed in Orlando?

Most financing options in Orlando can cover a wide range of roofing projects, including full roof replacements, repairs, and even upgrades like impact-resistant shingles or energy-efficient roofing systems. The scope of work and associated costs will determine the loan amount you may qualify for.

How much can I finance for my Orlando roofing project?

The amount you can finance largely depends on the lender, your creditworthiness, and the estimated cost of your roofing project. Many lenders offer financing options ranging from a few thousand dollars to $100,000 or more for major roofing projects.

What credit score is required for roofing financing in Orlando?

Credit score requirements vary among lenders, but generally, a higher credit score (680 or above) will qualify you for better interest rates and loan terms. However, some lenders may consider applicants with lower credit scores on a case-by-case basis.

How long do I have to repay a roofing financing loan in Orlando?

Repayment terms for roofing financing in Orlando can range from a few months to several years, depending on the lender and the loan amount. Typical repayment periods range from 3 to 10 years, but some lenders may offer longer terms for larger projects.

Are there any fees associated with roofing financing in Orlando?

Yes, most lenders charge fees for roofing financing, such as origination fees, processing fees, or prepayment penalties. Be sure to review all associated fees and costs before accepting a financing offer to understand the total cost of borrowing.

Can I finance my roofing project if I have an HOA in Orlando?

Yes, you can typically finance your roofing project even if you live in an HOA community in Orlando. However, you may need to obtain approval from your HOA for the roofing project and provide documentation to the lender.

Are there any special financing options for energy-efficient roofing in Orlando?

Some lenders and government programs may offer special financing options or incentives for energy-efficient roofing projects in Orlando. These could include lower interest rates, longer repayment terms, or tax credits for qualifying projects.