Brenda Roetger: The Small Town Mortgage Loan Officer Who Made It Big

Brenda Roetger is a highly experienced and respected mortgage loan officer with over 15 years of experience in the industry. She has built a reputation for her expertise, professionalism, and dedication to helping clients achieve their homeownership dreams. Roetger holds a Bachelor’s degree in Finance from a prestigious university and is a Certified Mortgage Banker,…

Mobile Insurance Claims Made Simple – Follow These 5 Tips

A mobile insurance claims is the process of filing and managing an insurance claim using a mobile device, such as a smartphone or tablet. It allows policyholders to initiate and complete the claims process entirely through a mobile application or mobile-friendly website, without the need for traditional paper forms or in-person interactions. Mobile insurance claims…

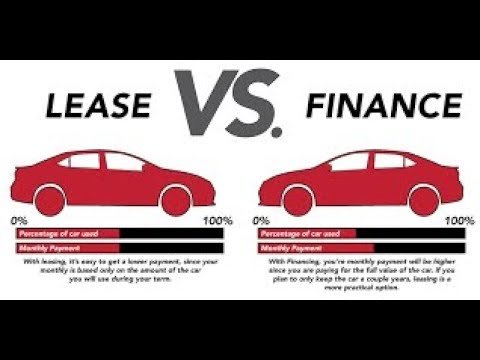

Lease or Finance a Car in 2024? How to Get the Best Deal

When it comes to acquiring a new car, you have two primary options: leasing or financing. This decision can have significant implications on your budget, lifestyle, and long-term financial goals. Leasing a car involves paying a monthly fee to use the vehicle for a predetermined period, typically two to four years, after which you return…

Best Online Finance Courses for Your Career Goals

Online finance courses have become increasingly popular in recent years, offering a flexible and affordable way to gain valuable knowledge and skills in the field of finance. These courses are designed to provide students with a comprehensive understanding of financial concepts, principles, and practices, without the constraints of traditional classroom settings. The rise of online…

7 Proven Tactics to Increase Insurance Agent Productivity

Productivity refers to the efficiency with which work is accomplished, measured by the output produced per unit of input. In the context of insurance agent s, productivity is essential as it directly impacts their ability to generate sales, provide excellent customer service, and maintain a healthy work-life balance. Highly productive insurance agents can handle more…

Affordable Financing Options for Orlando Roof Repairs

Roofing financing in Orlando refers to various financial options that allow homeowners to pay for their roof replacement or repair project over time, rather than paying the entire cost upfront. In the Orlando area, where severe weather conditions like hurricanes and storms can cause significant damage to roofs, having access to financing solutions is crucial…

Loaner Car: Your Temporary Ride Solution

When your car needs repairs or maintenance, a loaner car can be a big help. A loaner car, or courtesy car, is given by dealerships or rental companies. It lets you keep moving while your car is being fixed. This article will cover what loaner cars are, their benefits, and how to use them well. A sleek, modern loaner car…

Taking an Acura Loaner Out of State: What You Need to Know

A loaner car, also known as a courtesy car or service loaner, is a temporary replacement vehicle provided by a car dealership or manufacturer to a customer whose personal vehicle is undergoing repairs or maintenance. To be eligible for an Acura loaner car, you generally need to have your vehicle serviced at an Acura dealership…

Break Free of Title Loans: Companies That Pay Off Your Debt

A title loan is a type of short-term, high-interest loan where borrowers use their vehicle’s title as collateral. In this arrangement, the lender holds onto the car’s title until the loan is fully repaid. Title loans are designed to provide quick cash to borrowers, often without requiring a credit check or proof of income. To…

A Comprehensive Guide to 2nd Position Home Equity Loan in Daly City

Are you a homeowner in Daly City looking to tap into the equity you’ve built in your property? A 2nd position home equity loan can be a great way to access the funds you need for home renovations, debt consolidation, or other major expenses. But with so many options available, it can be overwhelming to…